Table of Content

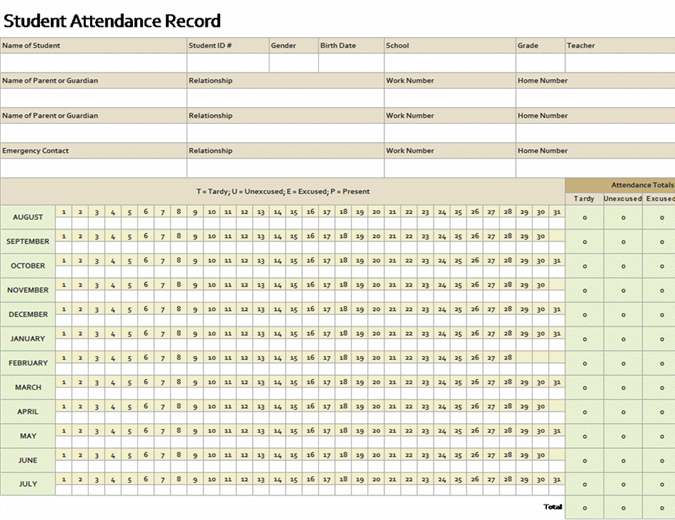

For this, select cell J11 and insert the addition formula into that cell. Subsequently, select the first month of principal remaining. At this moment, we will calculate the monthly principal with the help of a simple subtraction method. So, we put the previous cell in for the first month but with the absolute reference. In the first place, we will create columns for Months, EMI, Principal, Interest, Principal Remaining, and Prepayments. The Principal Amount and Interest Amount are the two basic components of the EMI.

The following table shows locally available mortgage rates which you can use to help calculate your monthly home loan payments. Mr.X has taken the home loan of Rs 20 lakh for loan tenure of 20 years @ 10.5 % interest rate. If Mr.X does not opt for any prepayment he will end up paying Rs 20 lakh principal and net interest of Rs.26.4 lakh. In this excel, you have two types of amortization tables.

# Principal and Interest paid after a specified period

All you need to do is simply enter your loan details and then enter the amount you wish to pre-pay. Do keep in mind that this amount will have to be at least three times the calculated EMI. If the borrower is making the prepayment from his own funds. Home Mortgage Calculator at Bankrate.com - For an online mortgage calculator, this is a pretty good one. To obtain a commercial use license, purchase the Vertex42 Loan Amortization Schedule.

However, due to the economic crisis, you may face job loss or a dip in your income (if you are self-employed). Hence, already have the plan to face such situations. The best example to prepare is having enough emergency corpus (ideally around 6-24 months of your monthly expenses including the EMI part also). Also, read why taking personal loan for downpayment is not advisable. Since most home loans are floating rate loans, the actual loan rate changes over the course of the loan depending on whether RBI policy rates are being hiked or cut.

Home Loan - Fees and charges

How much principal and interest are paid in any particular transaction. In the future, let us dig deeper into like what is the best way to clear your home loan. This is an effort to simplify your confusion about the home loan. I did my best in making sure that the calculator is error-free. However, if you found any, then please point to me. # For 15 years of the loan, it will take around 6.4 years.

Home loan emi calculator free excel sheet stable investor from i1.wp.com it is easy to prepare an emi table in excel sheet. Home loan emi calculator excel sheet with prepayment option. Download emi calculator for free & learn smart tricks to save your hard earned money.

Home Loan Calculator with Prepayment

Easily, we can detect that the Total Amount to be Paid here is greater than that of with the $5,000 Prepayment. Here we used the same arguments and cell references as in Step 1. The new thing which hasn’t been used before is the cell reference B10. After that, use the Fill Handle tool and drag it down to cell C21 in order to get the same EMI amount of other months. This Principal Remaining amount is at the beginning of the first month. So, the EMI will be calculated based on this amount.

According to RBI, lenders cannot charge a prepayment penalty once the home loan enters the floating rate period. If the loan is still in the fixed rate period, lenders can charge a penalty. Use the housing loan partial prepayment calculator to get an estimate on your monthly EMIs if you do opt to make the prepayment against your home loan. Grihashakti offers a free housing loan prepayment calculator which can give you instant results. Existing home loan customers can use this automated tool to determine the amount of savings that they can make by opting to make a part-prepayment on their home loan. Download the free excel Home Loan EMI Calculator where add loan prepayment at regular or irregular frequencies .

Loan for our own residence without having money to acquire a house. Home loan EMI calculator is one of the tools that help you plan your own house. Home Loan one of the life-supporting toll for the majority of employees or self-employed. Have you calculated, Is it really financially beneficial or you are paying your valuable earning to the Bank. Frankly speaking, you are paying more than double to the Bank for your Home Loan.

The calculator will also give you the EMI principal and interest calculator breakup in excel. Owning a House attached emotional value for every person, Living your life in the rented house always have the possibility to vacant somehow or other. Now, to update interest we will use a built-in function in Excel which is the SUMIF function. So, choose the cell J8 and type the formula into that cell. Consequently, select cell E7 and insert the formula into that selected cell. Then, input the numbers of months in the Months column.

During the initial stage of the loan, the interest part will be higher in your EMI. However, as the loan turns older, the principal part increases, and the interest part decreases. Let us take an example of a Rs.1 Cr home loan with an interest rate of 8% and when the principal part will start to overtake the interest part. A home loan is one of the longest forms of your commitment. Hence, obviously, borrowers look for the pros and cons of committing to such long-term loans.

In this formula, r stands for the rate of interest. The calculator updates results automatically when you change any input. This will serve as proof that property is now debt-free and it belongs to you entirely.

The initial principal amount is lower, but it rises over time. Additionally, the interest charge is large initially before declining over time. This is why we want to make an effort to pay in advance throughout the first few months. In this step, we’ll calculate the monthly Interest that we have to pay in our EMI. Finally, you can easily download the Excel-based spreadsheet and enjoy the benefits.

We also want to calculate the remaining principal amount for each month. Now, we’ve added the ABS function in front of our previous formula. The absolute value of a number is its value devoid of its sign. Again, select cell C10 and edit the formula like below. Firstly, select cell F9 and write down the formula below.

Step 5: Evaluate the Total Amount to be Paid of Home Loan Calculator with Prepayment Option in Excel Sheet

Step 1 – Click to this link Home loan EMI Calculator excel sheet with prepayment option India. Payments per year - defaults to 12 to calculate the monthly loan payment which amortizes over the specified period of years. If you would like to pay twice monthly enter 24, or if you would like to pay biweekly enter 26.

No comments:

Post a Comment